unfiled tax returns statute of limitations

Assessment Statutes of Limitations. The general statute of limitations on tax assessment is three years.

Irs Tax Settlement Company Late Or Unfiled Irs Tax Returns Michigan

To be in good standing with the IRS you must file six years of back tax returns.

. This very unfavorable statute limits the time a taxpayer can claim a refund from the IRS. For the most part the Statute of Limitations for the IRS to evaluate Taxes on Taxpayer lapses three 3. In fact there is no IRS statute of limitations on unfiled tax returns in general which can leave you feeling exposed.

If you are bringing a claim in New Jersey on behalf of a child under the age of 18 the statutes of limitations are a little bit different. Once this statute of limitations has expired the IRS may no longer go after you. There is no statute of limitations on a late filed return.

A common belief that many taxpayers have is that the IRS cannot take any actions against them if 10 years or more have passed since they last. The Statute of Limitations for Unfiled Taxes. However in practice the IRS.

The IRS generally assesses interest and penalties when returns are filed late. The IRS gives you 3 years from the due date of the return plus extensions to file your tax returns and 2 years from the date of payment whichever is later to claim your refund. The IRS can go back to any unfiled year and assess a tax deficiency along with penalties.

However in practice the IRS rarely goes past. Taxpayers can claim a refund from up to 3 years of the original due date of the tax return. Deadlines For Assessments And Collections.

The IRS can go back to any unfiled year and assess a tax deficiency along with penalties. 1 Four Things You Need to Know If You Have Unfiled Tax Returns. The penalty for filing late is 5 of the taxes you owe per month for the first 5 months up to 25 of your tax bill.

The statute of limitations permits a. An audit on an SFR can occur at any point. 21 Figuring out Your Collection Statute Expiration Date CSED 3.

For example if the child is 10 years old at the. For NJ state you can file an amended return anytime but to claim a refund the amended return must be filed within 3 years from the original due date of the return in. The IRS also has six years to audit your tax return and assess additional tax on income related to undisclosed foreign financial assets if the omitted income is more than.

The Statute of Limitations Only Applies to Certain People. If you are due a refund however you only have three years from the. If your return wasnt filed by the due date including extensions of time to file.

There is no statute of limitations on a late filed return. 2 The Statute of Limitations for Unfiled Taxes. In fact there is a statute of limitations that applies to collections by the IRS but it only pertains to taxpayers who have.

You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure. The purpose of the statute of limitations is to encourage a taxpayer or other type of legal plaintiff to take action within a reasonable amount of time. Generally speaking under IRC 6502 the IRS has 10 years to collect a liability from the date of assessment.

Documented Tax Returns. Unfiled Tax Returns Statute of Limitations. If you filed a return you should keep your records at least this long in case you are.

In New Jersey the statute of limitations for personal injurythe time in which you must file your complaint is two years after the cause of any such action shall have accrued.

Unfiled Tax Returns Free Yourself From Irs Problems

Articles About Federal Tax Issues From The Lawyers Of Silver Law

Unfiled Tax Returns Total Guide On Past Due Taxes In 2022 Supermoney

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Tax Returns What To Do Tax Problem Solver

When The U S Tax Law Has No Statute Of Limitations Against The Irs I E For The U S Citizen And Lpr Residing Outside The U S Tax Expatriation

Vulnerable With Unfiled Tax Returns What To Do Now

Gross Income Omissions And The 6 Year Tax Assessment Period

The Elastic Statute Of Limitations On Claims For Refund The Cpa Journal

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

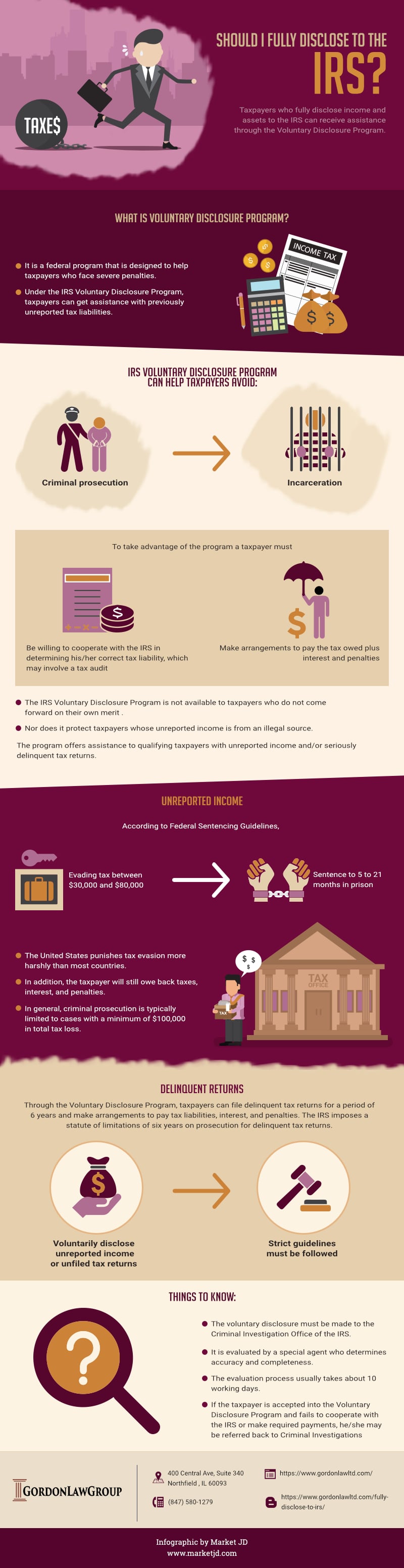

Irs Tax Audit Voluntary Disclosure Of Income And Assets

:max_bytes(150000):strip_icc()/what-if-someone-else-claimed-your-child-as-a-dependent-14afba0c76f846a1a86345d929b455e8.jpg)

Irs Statutes Of Limitations For Tax Refunds Audits And Collections

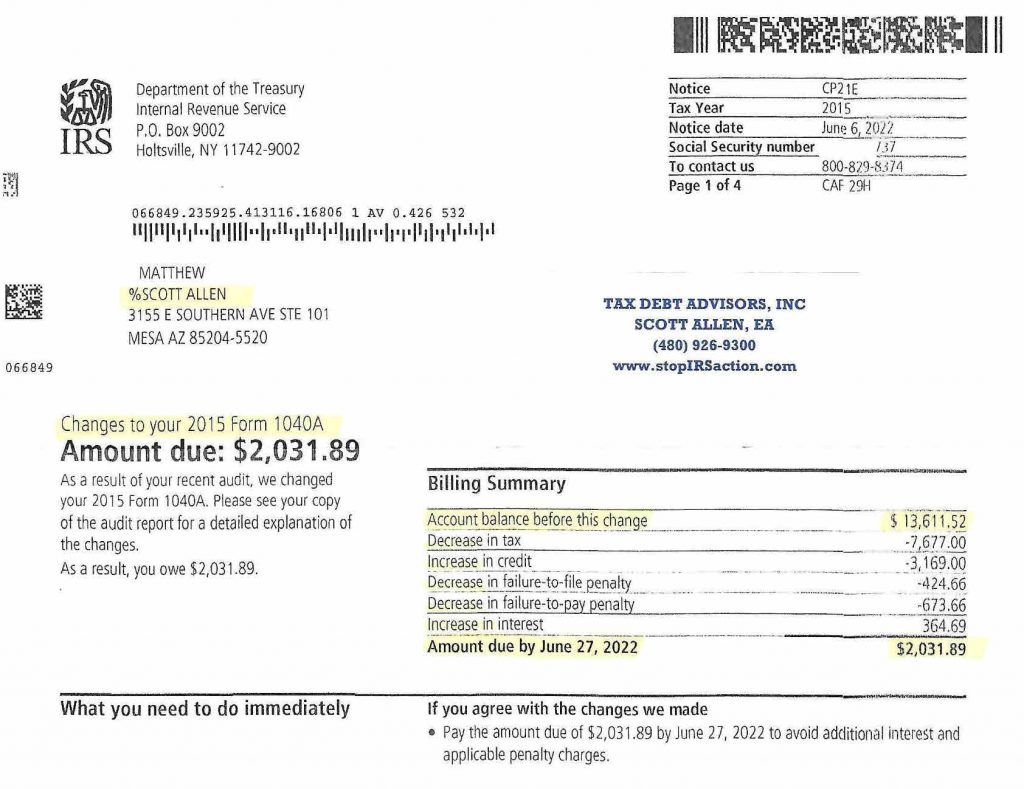

Unfiled Tax Returns Tax Debt Advisors

Unfiled Tax Returns Four Things You Must Know Youtube

Haven T Filed Taxes In 1 2 3 5 Or 10 Years Impact By Year

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Statute Of Limitations For Taxes Washington Dc Tax Attorney

Irs Can Audit For Three Years Six Or Forever Here S How To Tell